do i have to pay tax on a foreign gift

If you are a US. Gifts are not reported on a federal tax return regardless of the amount received.

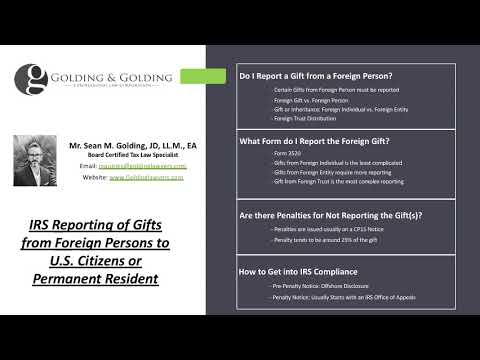

Gifts From Foreign Person How U S Citizens Residents Report A Foreign Gift To Irs On Form 3520 Youtube

The fact that the gift is from a foreign person is irrelevant.

. Generally the answer to do I have to pay taxes on a gift is this. If the donor does not pay the tax the IRS may collect it from you. 2020-21This caller is receiving a gift from his family in Bangladesh.

Then this will need to be declared to. Currently on target to remain within the within the 32 bracket but this would push me up to the 35 bracket. Person receives one or more gifts from a Foreign Person individual entity or trust the recipient may have to report the value to.

If you receive a foreign wire transfer as a gift you wont have to pay tax on it but you may need to report it to the IRS. Gifts are not income. Gifts From Foreign Person IRS Reporting.

Person from a foreign person that the recipient treats as a gift and can exclude from gross income. The person who does the gifting will be the one who files the gift tax return if necessary and pay any tax due. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the nonresident alien.

The recipient will not have a requirement to include the gift in their gross income. Enter the tax period MMDDYYYY. However if you are UK tax resident and you make a capital gain abroad from the sale of a property.

However you may be required to furnish proof that you paid any estate or gift tax to a foreign government. In order to keep tabs on American money. Making cash gifts to foreign citizens.

For tax year 2022 if you gift over 16000 to a single. If a gift exceeds the annual exclusion amount. While you may not need to pay tax on large sums of money being sent abroad.

Foreign Gift Tax the IRS. To compensate for this the. Since the gift is from a foreign person if the gift received during the year is 100000 or more you will need to.

Person gives a gift that exceeds the annual exclusion amount they typically must file a Form 709 unless an exception or exclusion. DO NOT make any other selections in items 6-8. The person receiving a.

Do I have to pay Taxes in the US. If the tax period is unknown refer to the. You will not have to pay tax on this though.

I received a foreign gift. Although you probably wont have to pay United States taxes on your foreign inheritance as an expatriate reporting it to the IRS is still necessary. Person other than an organization described in section 501c and exempt from tax under section 501a of the Internal Revenue Code who.

If any foreign gift tax is applicable the donor will be responsible for paying the tax on Form 709. There will be no income tax due on the gifting of money. The IRS defines a foreign gift is money or other property received by a US.

The same is true for those who receive an inheritance. International Tax Gap Series. You do not have to pay tax on gifts you receive.

For tax year 2022 unless you have gifted over 1206 million over your lifetime there is no federal taxes on gifts given to individuals. If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value. Advertisement Foreign Wire Transfers.

The ONLY option available for gift tax is 6b. Gifts to foreign citizens are subject to the same rules governing any gift that a US. There are forms to repor.

Cash gifts from parents who qualify as foreign persons dont subject the recipient to taxes. The burden of paying the gift tax falls on the gift-giver.

Foreigners Can Avoid U S Gift Tax With Proper Planning Meg International Counsel Pc

Inheritances And Gifts With A Foreign Element Rodl Partner

Foreign Gift Reporting Requirements Henry Horne

Form 3520 What Is It And How To Report Foreign Gift Trust And Inheritance Transactions To Irs Youtube

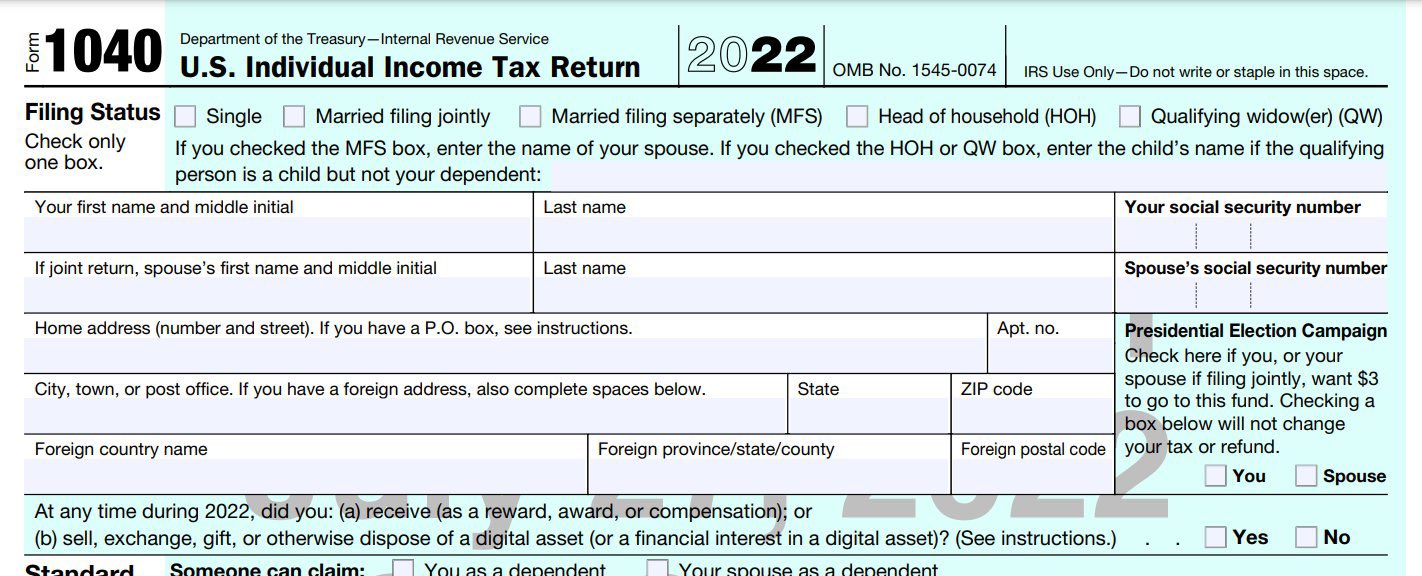

Crypto Tax Girl On Twitter The Irs Has Updated The Crypto Tax Question On The Draft 2022 Tax Form Https T Co Edyly45cas Twitter

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Foreign Clients Take Care When Making Gifts This Holiday Season Insights Events Bilzin Sumberg

Failure To Disclose Foreign Financial Assets A Tax Brief Sommers Robert L 9780977861613 Amazon Com Books

How Are Gains On Foreign Stock Investments Taxed Forbes Advisor India

Reporting A Gift From A Foreign Source Taxcpe

Irs Reporting Requirements For Gifts From A Foreign Person

How To Report A Foreign Gift Or Inheritance Of More Than 100k Schwartz Schwartz Pc

Do You Have To Pay U S Taxes On Foreign Inheritance Us Tax Help

The Estate Tax And Lifetime Gifting Charles Schwab

Reporting Requirements For Us Tax Persons Who Receive A Foreign Gift

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

Form 3520 Reporting Foreign Trusts Inheritances And Gifts For Americans Abroad H R Block